With the currency rates standing at where they are, and the continuous dipping of the Sri Lankan Rupee, it’s probably safe to assume that we are all somewhat used to carrying around a sheaf of notes with us wherever we go. Although supermarkets and the likes have adopted to using newer means of payment such as credit/debit cards, sadly this does not apply to the vegetable stall at the local pola. Or the myriad folks who deliver goods but are at a loss the moment they find out you are not carrying exact change on you.

The solution to this lies in using plastic over paper, but then again when you try to apply this to a realistic scenario, in Sri Lanka, there are two factors especially that keep getting in the way.

Somewhat Exclusive Availability

In order to get yourself a free card reader in the local sphere, you would need to meet a minimum transaction quota required by financial institutions who facilitate the said service. This requirement calls for approximately Rs. 300,000-350,000 worth of transactions to take place within a period of one month.

Outdated Technology

The technology that’s currently in use relies heavily on the audio jack. Image credit: alibaba.com

The mobile card readers that are currently in use employ the audio jack in the seller’s phone to connect to and communicate with their backend. In a nutshell, it’s digital technology piggybacking on analogue technology, something that although not conventional, is in heavy usage right now (we’ll go into the problems of using this technology in detail in a bit).

PAYable is a startup backed by CBA Solutions that’s aiming to disrupt the existing card reader system in the market ‒ and they plan to do so with their own card reading device. The biggest difference between their solution and ones that are out on the market, lies in the technology being used to communicate with the host device and the card reader. Whereas traditional devices rely on the audio jack (and accompanying analogue technology), PAYable aims to disrupt this by replacing the audio jack with the more modern/convenient Bluetooth connectivity.

Co-Founders of CBA Solutions – Yohan Wijesiriwardane, COO and Sujith Subasinghe, CEO

Roar met up with PAYable co-founders, Yohan Wijesiriwardane, COO, and Sujith Subasinghe, CEO, for a quick chat on what’s special about the technology they plan on introducing to Sri Lanka.

PAYable Solution

According to present estimates, over 50% of our GDP is generated by SMEs which in turn accounts for a hefty 80% of all businesses in the country. They also provide employment for as much as 35% of the country’s labour force. Taking this into consideration, the fact that such businesses are constrained to cash payments only is something worth being worried about.

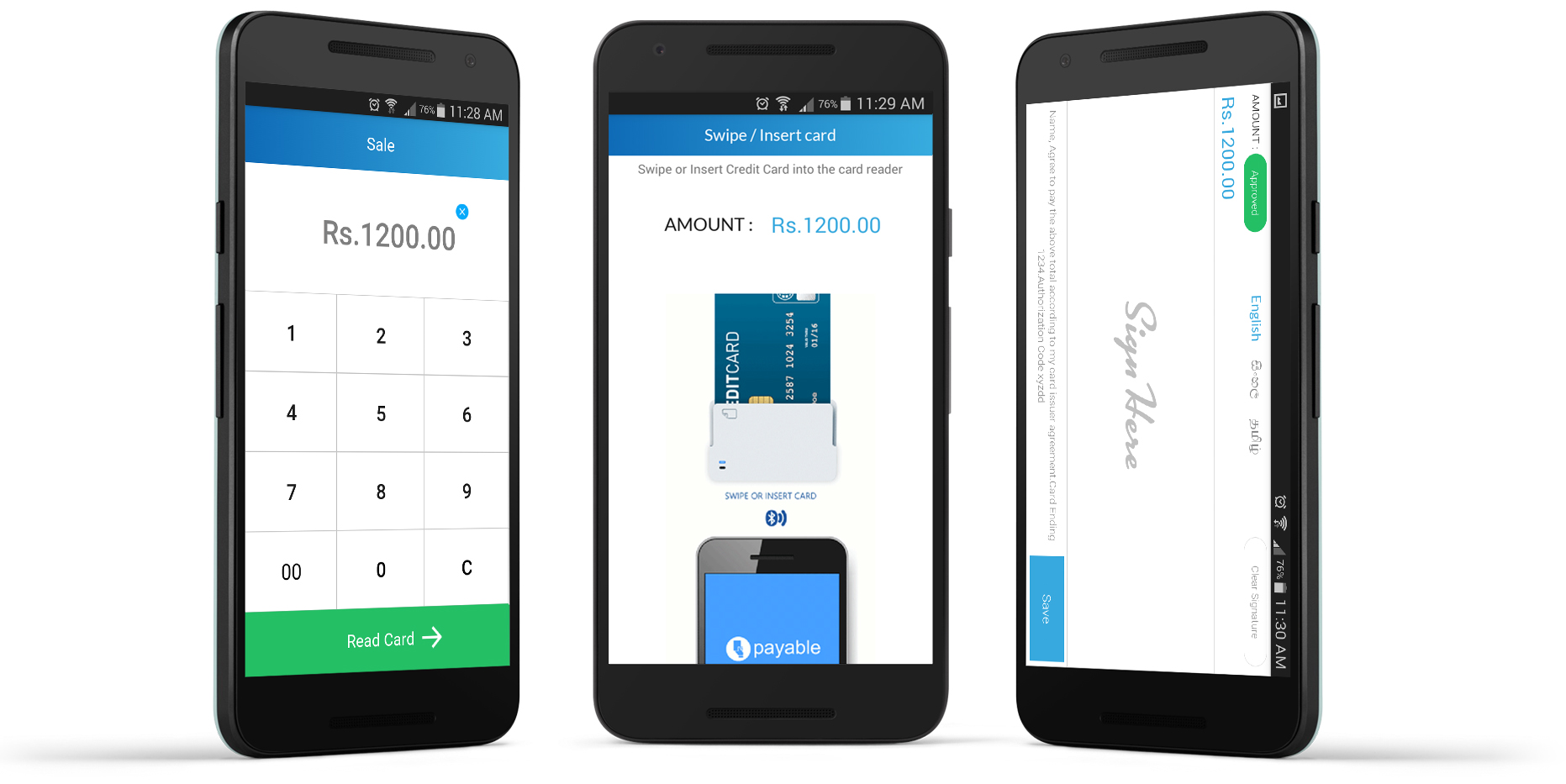

PAYable is a user-friendly app that works with any Android or iOS smart

phone or tablet device enabling mobile cashless transactions

PAYable is introducing two devices to the market, PAYable Reader Plus (bigger device with numeric pin pad) and PAYable reader (smaller, basic device). Reader Plus is capable of performing 8,000 magnetic strip reads or 800 EMV chip transactions on a single charge, which take approximately 85 minutes, whereas the smaller device (PAYable reader) can perform 4,000 magnetic strip reads or 500 EMV chip transactions when full. The charging time on the smaller device is only 60 minutes.

The use of a Bluetooth card reader makes PAYable a more robust system

Now that we have a brief idea on what the two devices are capable of, let’s explore some areas where they outshine the existing technology that’s out there right now.

Connectivity

Although the audio jack based connection on devices has been in use for a while, not only have there been concerns and complaints about lower-end phones giving mis-reads through the audio jacks, but also breakdowns when water gets in the way. Seeing as a majority of delivery services depend on mobile readers, weather sensitive hardware can pose a bit of a problem, and this is something PAYable plans to address with their readers, which feature Bluetooth as a bridge.

Security

PAYable supports PIN authorisation on card transactions

[Tech jargon alert] PAYable uses DUKPT encryption in all of their transactions. For those of you who are curious, DUKPT, or the Derived Unique Key Per Transaction model, works around the premise of using a unique key derived from a fixed key for every transaction. So not only does it reduce the possibility of someone sniffing out the details in the transmission, but also gives added protection from any malware that might be in the phone being used.

On top of all this, PAYable’s accompanying app for the hardware features all three languages, which we are sure makes things easy for both delivery persons and customers.

With PAYable, the founders’ main focus lies in elevating the SMEs in the local sphere who are getting by without mobile card readers. This could apply to a vast spectrum of sellers, from your vegetable vendor at the Sunday pola to delivery services who have had to rely on a cash-on-delivery system so far.

Potential Issues With PAYable’s Model

Although this solution comes with a host of features which could help in refining the user/seller experience around credit/debit cards, there are a couple of issues that we can see hindering the overall experience.

Battery Drainage

One of the lesser appreciated qualities of Bluetooth lies in the way it contributes to battery drain on handheld devices when left on(you might have experienced this with headsets/fitbits). When it comes to using the device with a paired smartphone running the native app, chances are you will be draining the juice on said device as well. Which will not be good news for units that will have heavier use.

Interference

Bluetooth technology is based around using waves to transfer information over the air. Although highly convenient, one problem that can come out of using Bluetooth is how external factors such as being around a microwave/WiFi or anything that uses radio waves can interfere with its function.

Resource Sharing

On a more day-to-day application, chances of the delivery person already using a Bluetooth headset/some other component are somewhat high. And using another Bluetooth device to process card reads could (potentially) get in the way leading to a bit of a hassle on the user’s end, where multiple pairings/tetherings are concerned.

All in all, what PAYable is introducing to Sri Lanka is a fresh take on mobile POS transaction devices. And they are capable of incorporating extra features such as mobile printers for receipts, if there’s enough demand. PAYable seems like a step in the right direction when it comes to empowering SMEs on a national scale.

Images courtesy of PAYable.